Introduction

A market model denotes how the demand and supply linked to each other to indicate the prices and the quantity of the product. A market model is mostly used due to its accuracy. The difference in the inclination for various products and price correlation in different categories provides the government with a framework of taxing alcohol. A tax on alcohol can be suitable for addressing externalities caused by alcoholism such as obesity. The authority has used taxation for a long time to correct the habit of overconsumption of alcohol in society (Yeomans, 2019). Therefore, initiating a tax equivalent to the marginal costs of consumption is an appropriate way to correct the negative implications caused by alcoholism. The externalities out of alcohol consumption vary from one drinker to another in society. For instance, a heavy consumer on his 10th bottle is more likely to cause harm to others than a lighter drinker on his 2nd (Yeomans, 2019). In the US, the populace of binge drinkers is 7%, but they account for 75% of the costs of excessive alcohol consumption. Therefore, the essay aims to analyse how a tax impacts alcohol consumption using the market model.

An Analysis of the Impact of a Tax on Alcohol

The government mostly imposes a tax rate on alcohol equivalent to the average marginal externality across consumers. Wilson et al. (2018) indicate that there is a possibility to improve on this optimum single rate by putting various taxes on different alcohol products. Even if the externality is caused by alcohol, it is bundled with other brand qualities that drinkers may otherwise consider. The relationship between the demand for various alcohol brands and the marginal externality of ethanol intake makes the tax rates on alcohol to improve welfare. When considering an example of two kinds of alcohol takers – heavy consumers and light ones, the heavy drinker decides to consumer wine while the light one takes beer. Usually, light consumers have a zero marginal external cost connected with their drinking, and they only consume beer. However, both consumers will face a tax equivalent to their marginal external cost. The optimum single tax applied both on the wine and beer is equivalent to the average marginal external costs across the two kinds of consumers. The fluctuating alcohol taxes across different products can help in improving welfare.

According to the law of demand and supply, imposing taxes on alcoholic drinks is an appropriate way of reducing the abuse of the product in society since the level of the product consumption will reduce drastically to a point where the marginal cost is equivalent to the marginal benefit (Wilsonet et al., 2018). Moreover, some adverse externalities such as lawlessness will lessen making a society a better place to live. Alcohol consumption will decline since taxing alcoholic drinks will lead to an increase in the prices of the product. According to the law of demand, the demand for alcohol may deteriorate in society when the prices are higher. Thus, the reduction will equate with the decrease in the number of social issues caused by alcohol abuse. For example, the numbers of alcohol-related deaths will decline, and many alcoholics will lead responsible lives.

Moreover, the government considers external costs factors while imposing taxes on alcoholic drinks. The economic costs of excessive consumption of alcohol are high since the consumer may receive other diseases in the process. Imposing taxes on the product is appropriate for its aid in reducing the external costs related to excessive drinking in society. Additionally, the level of production in a nation will increase since excessive alcohol consumption is the major cause of low productivity in many places of work. Alcohol consumption leads to adverse externalities that are not equivalent to the total cost of the alcohol consumed. Thus, a massive imposition of taxes on alcoholic drinks is one of the mechanisms to reduce the externalities caused by excessive alcohol consumption (Yeomans, 2019). The tax imposed on alcoholic drinks depends on the concentration of alcohol externalities among binge drinkers. Nevertheless, the government fluctuates the taxes on alcohol, depending on the type of drink. For instance, alcoholic beverages with higher ethanol concentration are most likely to be taxed heavily because the externalities associated with them are alarming (Yeomans, 2019). High taxing of harmful alcoholic drinks such as whisky may reduce some of the negativities associated with them such as diseases, thus saving families some costs. In taxing alcoholic drinks, the optimal tax is dependent on the price elasticity across the product and the externalities associated with the heavy consumption.

In imposing duties on alcoholic drinks, the UK government considers two distinct taxing systems. The single tax system, for instance, which is mostly levied on alcohol, focuses directly on the externalities caused by binge drinking. Conversely, the multi-tax system targets all types of alcoholic drinks in the market. The government mostly consider the single system since it is one of the ways of reducing some of the externalities caused by excessive alcohol abuse (Yeomans, 2019). In the UK, alcohol is majorly taxed per litre of ethanol and wine hence making the prices of many alcoholic drinks to elevate. The government introduced the measure as a way of curbing excessive alcohol consumption. The authority has also implemented other by-laws such as outlawing the selling of alcoholic drinks as a mechanism to reduce the alcoholism habit among individuals. The World Health Organisation urges governments to use taxation as the major mechanisms of dealing with excessive consumption of alcohol.

In the UK, policymakers use taxation as an instrumental way of curbing excessive alcohol consumption. The taxing per ethanol concentration criterion has reduced the production of illicit brews that have affected many individuals health leaving others with diseases such as cirrhosis. The government, through its appropriate taxing program, has set prices for certain alcoholic drinks as a mechanism to reduce excessive intake of alcohol (Wilson et al., 2018). Taxes represent a significant component of the alcohol prices since drinks that are heavily taxed costs highly. In other places in the UK, the authorities have obtained an accurate alcohol price that determines prices and alcohol content of the drinks sold. Thus, the process keeps many alcoholics healthier for they consume quality products that may not affect their health.

In the market model, the forces of demand and supply interact through taxation to determine the prices of different alcoholic drinks. The price determining procedure is appropriate as it sets some reasonable charges on the products, which limit their excessive consumption. For that reason, the externalities associated with heavy drinking, such as domestic violence have reduced significantly in the UK (Holdsworth, 2018). In determining the prices of alcoholic drinks, the government employs one quality of a market model, which is perfect competition. The authority observes how the market is concentrated by a higher number of small traders who compete to sell their alcoholic commodities to people. As a result, they impose taxes to increase the price of the product to reduce the number of sellers in the market. Therefore, that will aid in reducing the number of alcohol consumers in society.

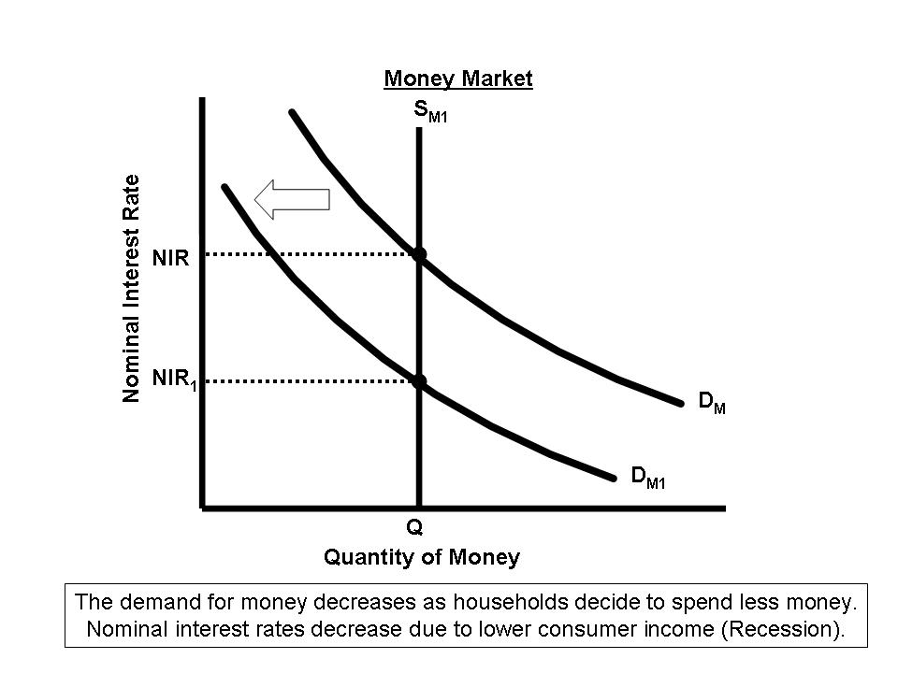

Figure 1. Normal interest rates versus the quantity of money (Holdsworth, 2018).

The graph in Figure 1 reveals how the demand for money is presently high due to alarming rates of unemployment. Thus, the increase in alcohol prices may affect normal consumption since individuals may not reach their daily consumption target. The development is appropriate as it will help to reduce some of the negative repercussions caused by alcoholism in society (Angus, Holmes, and Meier, 2019). Moreover, as the quantity of money rises, the alcohol demand may augment since drinkers can afford all kinds of liquor. Taxing is the major reason for increasing alcohol prices since the government rates it among the addictive products that have backslidden the British economy. Taxing, therefore, can work as an appropriate measure to reduce alcohol consumption in society.

Conclusion

Alcohol consumption is one of the factors that have affected the economies of many nations since it reduces the productivity of many individuals, especially the youth. In the UK, the authority uses the market model for analysing the impacts of taxing on alcoholic drinks in society. For instance, through taxing, the government has increased alcohol prices, thereby significantly reducing the number of binge drinkers. Moreover, taxing on ethanol encourages the government to tax some alcoholic beverages per ethanol content. As a result, alcoholic drinks with higher percentages are overpriced, thus helping to prevent some of the negative impacts caused by alcoholism.

References

Angus, C., Holmes, J. and Meier, P.S., 2019. Comparing alcohol taxation throughout the European Union. Addiction, 114(8), pp. 1489-1494.

Holdsworth, M., 2018. Association between alcohol taxes and health harms: a UK framework. Doctoral Dissertation. The University of Delaware.

Wilson, N., Blakely, T., Jones, A., Cobiac, L., Nghiem, N., Mizdrak, A. and Cleghorn, C., 2018. A public health perspective on taxing harmful products. [Online] Available at: https://blogs.otago.ac.nz/pubhealthexpert/2018/04/16/a-public-health-perspective-on-taxing-harmful-products/ [Accessed 28/10/2020].

Yeomans, H., 2019. Regulating drinking through alcohol taxation and minimum unit pricing: a historical perspective on alcohol pricing interventions. Regulation & Governance, 13(1), pp.3-17.